LX Costa Rica maintains an active market research team that monitors prices and trends in residential luxury properties in Costa Rica’s Central Valley. Although most of the research is destined for internal use by our luxury agents and the LX team as part of the planning and investment guidance for clients, in some instances we share parts of our research results with clients and LX Network partners that can build on the study with their own real estate and luxury market research.

“The market has changed. It’s currently very active, but there’s a large gap in prices and trends and also the expectations between sellers and buyers, with significant price adjustments.”

–Clari Vega, LX Managing Partner

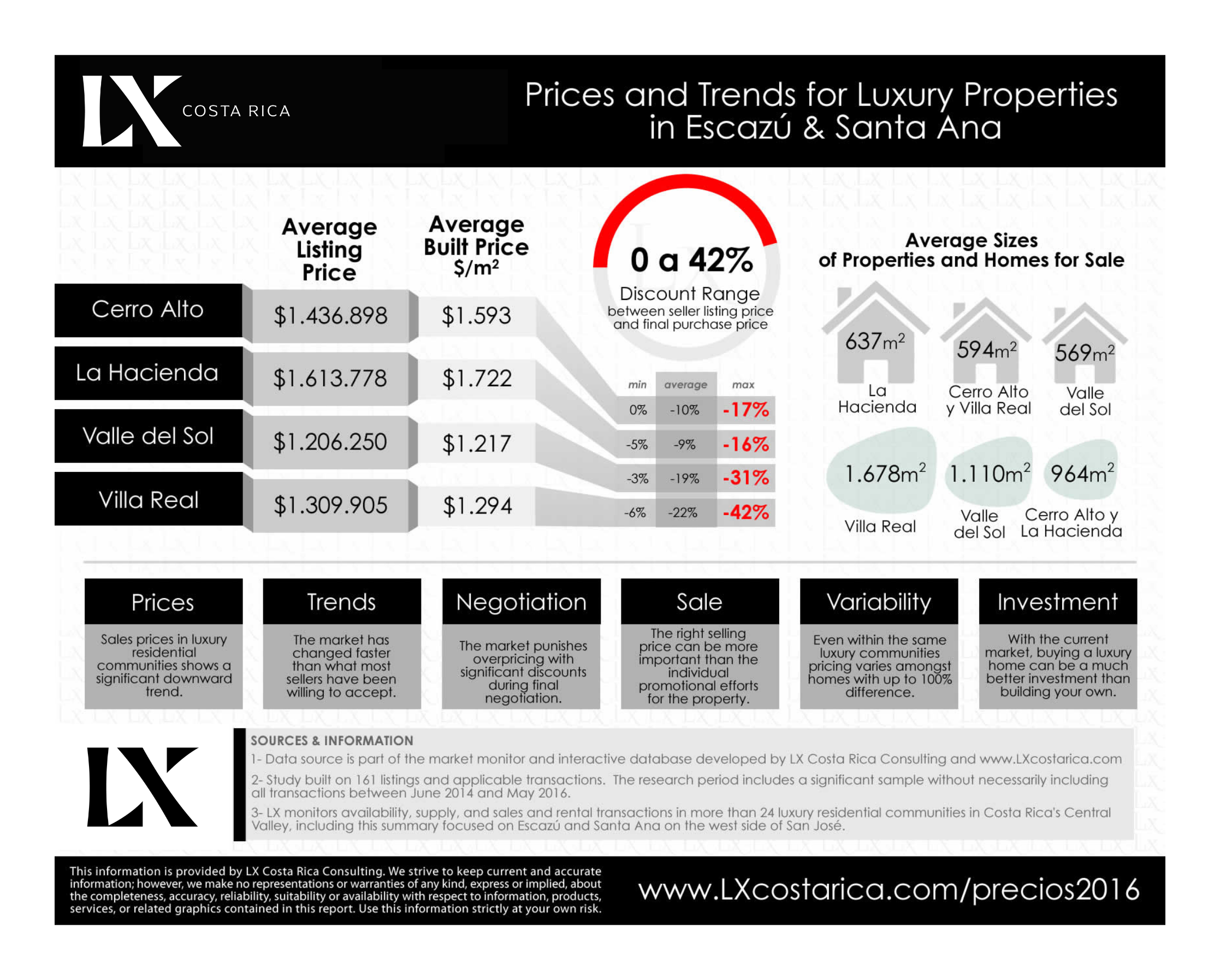

This study builds on market monitoring and the active LX Costa Rica Consulting database of market availability, offers, and sales and rental transactions in over 24 luxury residential communities on the west side of San José, mainly in Escazú and Santa Ana. Specifically, this summary presents four luxury communities as the most representative of the luxury real estate market in the area, with the highest volume of interest and transactions valued over $1 million USD: Cerro Alto, La Hacienda, Valle del Sol, and Villa Real. This part of the study used 161 listings and sales transacciones as a significant sample, without necessarily including all transactions realized between June 2014 and May 2016.

What are some if these prices and trends in the area?

Prices

Trends

Negotiation

Sale

Variability

Investment

NOTES: There are other luxury residential communities in the area with sales above $1,000,000, including many that are part of the LX property portfolio; however, these communities have less inventory of available luxury homes or they do not offer enough reference information for significant calculation. It’s also important to mention that 50% of the properties and transactions above $1,000,000 tracked as part of this research were independent homes that are not located within gated residential communities and are not considered although they generate strong impact on the market, transactions and movements in the area.